NuVision – a Nottingham-based company with a product that speeds up healing of eye conditions – has raised a further £1.1m investment.

The funding has come from existing investors including the MEIF Proof of Concept & Early Stage Fund, which is managed by Mercia and part of the Midlands Engine Investment Fund, Mercia’s EIS funds, Pioneer Group (formerly the BioCity Group), the University of Nottingham and private investors. It will enable NuVision to accelerate the development of its first two products in advance of a Series A investment in the next 12 months.

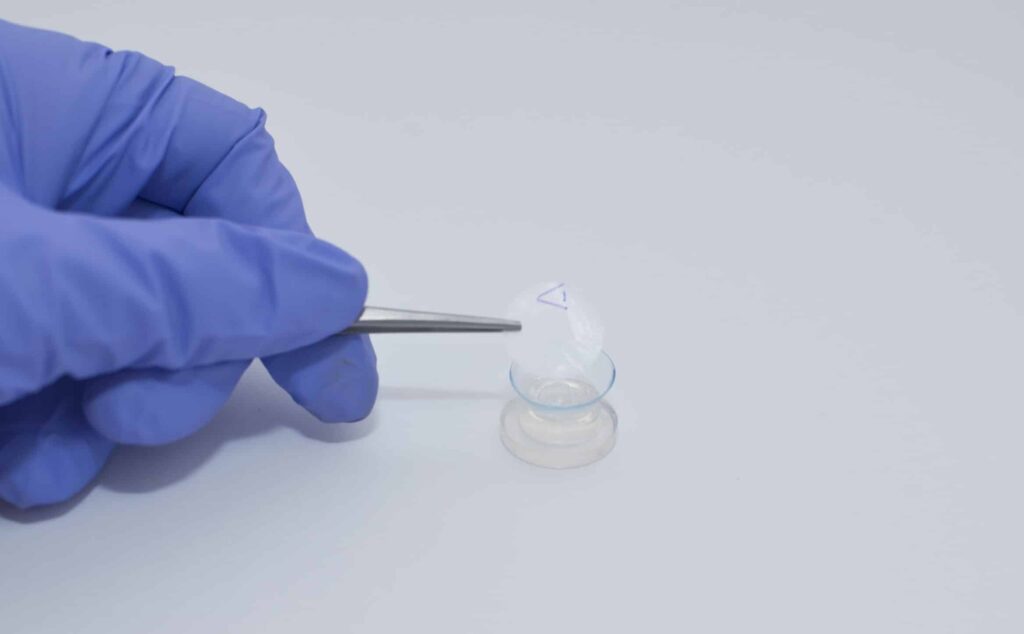

NuVision’s wound dressings are manufactured from amniotic membrane, the sac that surrounds babies in the womb, and are used to aid the regeneration and healing of the eye’s surface. Its first product, Omnigen, is already approved for treatment on the NHS and is used in hospitals and private clinics the UK and overseas.

Omnigen may be applied in the operating theatre or, when used in combination with the company’s bespoke bandage contact lens, OmniLenz, in the outpatient department or clinic. This enables patients to benefit from amniotic membrane without having to undergo surgery and can enable treatment at an earlier stage in the development of their condition.

Omnigen is a dry, room-temperature stable product that rehydrates on contact with natural moisture from the eye.

NuVision was founded in 2015 by Dr Andy Hopkinson based on his research at the University of Nottingham. The latest funding round brings the total raised by the company to over £5m.

“We are delighted to receive further support from our existing investors. This investment round is an endorsement of our innovative new therapies for ocular care and our commitment to developing rapid and accessible treatment for ocular injury. The next stage of development is the scaling of our commercial and operational capabilities ahead of a planned Series A round in late 2023 or early 2024.”

Andy Hill, CEO

Mercia first invested in the company in 2015.

Hannah Tapsell, Investment Manager at Mercia Asset Management, said: “Amniotic membrane has been used in healing for almost a century. NuVision’s unique cutting-edge biotherapy harnesses the benefits but in a format that makes it far more powerful and effective. Its product is already in hospitals in the UK and there is scope to expand its use to other conditions. The funding will enable NuVision to continue the good work and roll it out internationally so more patients can reap the benefits.”

Mark Wilcockson, Senior Manager at the British Business Bank, said: “The MEIF backs innovative businesses that create a positive impact in the Midlands region as a leader in their sectors. NuVision is the perfect example of how a university spin-out backed by investment can thrive to create a growing and sustainable business. We encourage other SMEs with similar business plans in the region to seek funding from the MEIF to scale up.”

Pioneer, which operates the BioCity Nottingham site where NuVision is based, has a long-standing collaboration with the company, having previously provided it with seed funding and tailored accelerator support.

Dr. Glenn Crocker, Executive Director of Venture Capital Investments at Pioneer Group, said: “Our follow-on investment in NuVision reflects the quality of the company and its steady growth journey. We have been impressed by its uniquely innovative approach to treating ocular surface disease in a natural way. We are also confident that NuVision’s effective solutions for regenerating and healing the eye surface have the potential to become real game-changers in ocular care.”

Dr. Alice MacGowan, Life Science Executive, Nottingham Technology Ventures, said: “The science underpinning NuVision’s technology was developed at the University of Nottingham, and we are very proud to see the ongoing patient benefit stemming from that research. The University co-invested in the recent round, demonstrating its confidence in NuVision’s team, plans for scale, and, above all, the treatment approach.”

The Midlands Engine Investment Fund is supported financially by the European Union using funding from the European Regional Development Fund (ERDF) as part of the European Structural and Investment Funds Growth Programme 2014-2020 and the European Investment Bank.

Mercia

Alison Dwyer

Head of Marketing & Communications

Mercia Asset Management PLC

+44 (0) 7464 480 137

Mercia

Pauline Rawsterne

PR Agent

Turquoise PR

+44 (0) 161 860 6063

+44 (0) 780 163 9816

NuVision Biotherapies

Andy Hill

CEO

Pioneer Group

Miranda Knaggs

Pioneer Group

Instinctif Partners (Media)

Melanie Toyne-Sewell / Giulia Lasagni / Feyi Ashamu

0207 457 2020

About Mercia Asset Management PLC

Mercia is a proactive, specialist asset manager focused on supporting regional SMEs to achieve their growth aspirations. Mercia provides capital across its four asset classes of balance sheet, venture, private equity and debt capital: the Group’s ‘Complete Connected Capital’. The Group initially nurtures businesses via its third-party funds under management, then over time Mercia can provide further funding to the most promising companies, by deploying direct investment follow-on capital from its own balance sheet.

The Group has a strong UK footprint through its regional offices, 19 university partnerships and extensive personal networks, providing it with access to high-quality deal flow. Mercia currently has c. £1.4 billion of assets under management and, since its IPO in December 2014, has invested over £96million into its direct investment portfolio. Mercia Asset Management PLC is quoted on AIM with the epic “MERC”.

The Group raises its own Venture Capital Trusts (VCTs) and Enterprise Investment Scheme (EIS) Funds and details about open offers can be found through Mercia’s website.

Mercia Asset Management PLC is quoted on AIM with the epic “MERC” and includes the following wholly owned subsidiaries –

- Mercia Fund Management Limited is authorised and regulated by the FCA under firm reference number 524856

- Enterprise Ventures Limited is authorised and regulated by the FCA under firm reference number 183363

- EV Business Loans Limited is authorised and regulated by the FCA under firm reference number 443560

About the Midlands Engine Investment Fund (MEIF)

The Midlands Engine Investment Fund, supported by the European Regional Development Fund, will invest in Debt Finance, Small Business Loans, Proof-of-Concept and Equity Finance funds, ranging from £25,000 to £2m, specifically to help small and medium sized businesses secure the funding they need for growth and development.

The Midlands Engine Investment Fund is operated by British Business Financial Services Limited, wholly owned by British Business Bank, the UK’s national economic development bank. Established in November 2014, its mission is to make finance markets for smaller businesses work more effectively, enabling those businesses to prosper, grow and build UK economic activity.

The Midlands Engine Investment Fund is supported by the European Regional Development Fund, the European Investment Bank, the Department for Business, Energy and Industrial Strategy and British Business Finance Limited, a British Business Bank group company.

The MEIF covers the following LEP areas: Black Country, Coventry & Warwickshire, Greater Birmingham & Solihull, Stoke-on-Trent and Staffordshire, The Marches, and Worcestershire in the West Midlands; and Derby, Derbyshire, Nottingham & Nottinghamshire (D2N2) Greater Lincolnshire, Leicester and Leicestershire, and South-East Midlands in the East and South-East Midlands.

The project is receiving up to £78,550,000 of funding from the England European Regional Development Fund as part of the European Structural and Investment Funds Growth Programme 2014-2020. The programme will continue to spend to the end of 2023.

The Department for Levelling Up, Housing and Communities is the Managing Authority for European Regional Development Fund. Established by the European Union, the European Regional Development Fund helps local areas stimulate their economic development by investing in projects which will support innovation, businesses, create jobs and local community regenerations. For more information visit www.gov.uk/european-growth-funding.

The European Investment Bank is providing £122,500,000 to support the Midlands Engine Investment Fund. This follows backing for the Northern Powerhouse in 2017 and backing for the newly launched North East Fund. For further information visit www.eib.org

The funds in which Midlands Engine Investment Fund invests are open to businesses with material operations in or planning to open material operations in the West Midlands and East & South-East Midlands.

The British Business Bank has published the Business Finance Guide (in partnership with the ICAEW, and a further 21 business and finance organisations). The guide, which impartially sets out the range finance options available to businesses and provides links to support available at a regional level, is available at https://thebusinessfinanceguide.co.uk

About the British Business Bank

The British Business Bank is the UK government’s economic development bank. Established in November 2014, its mission is to make finance markets for smaller businesses work more effectively, enabling those businesses to prosper, grow and build UK economic activity. Its remit is to design, deliver and efficiently manage UK-wide smaller business access to finance programmes for the UK government.

The British Business Bank’s core programmes support nearly £8bn[1] of finance to almost 94,800 smaller businesses[2]. Since March 2020, the British Business Bank has also launched four new Coronavirus business loan schemes, delivering almost £73bn of finance to around 1.6m businesses.

As well as increasing both supply and diversity of finance for UK smaller businesses through its programmes, the Bank works to raise awareness of the finance options available to smaller businesses. The British Business Bank Finance Hub provides independent and impartial information to businesses about their finance options, featuring short films, expert guides, checklists and articles from finance providers to help make their application a success.

In light of the coronavirus pandemic and EU Exit, the Finance Hub has expanded and it now targets a wider business audience. It continues to provide information and support for scale-up, high growth and potential high growth businesses, but now provides increased content, information and products for businesses in survival and recovery mindsets. The Finance Hub has been redesigned and repositioned to reflect this, during this period of economic uncertainty.

British Business Bank plc is a public limited company registered in England and Wales, registration number 08616013, registered office at Steel City House, West Street, Sheffield, S1 2GQ. It is a development bank wholly owned by HM Government. British Business Bank plc and its subsidiaries are not banking institutions and do not operate as such. They are not authorised or regulated by the Prudential Regulation Authority (PRA) or the Financial Conduct Authority (FCA). A complete legal structure chart for the group can be found at www.british-business-bank.co.uk.

About Pioneer Group

Pioneer Group’s mission is to help life sciences and high-tech businesses to thrive in tackling challenges in both human and planetary health. Across the UK and Ireland, Pioneer leads the way in integrating the provision of mission critical real estate, venture building and venture investment.

Since 2003 its connected cluster model has provided powerful sector-specific, business-focused ecosystems in which businesses are more likely to succeed.

Pioneer Group delivers the most comprehensive suite of accelerator and venture building activity across the UK and Ireland, helping founders to transfer cutting-edge discovery into visionary ventures that scale. Pioneer’s in-house team supports start-ups and scale-ups and works in partnership with organisations such as Innovate UK, AbbVie, Astellas, Academic Health Science Networks and many of the UK’s strongest universities.

Pioneer also backs game-changing, early-stage life science companies with investment from its venture capital funds, alongside ongoing mentoring and assistance. The focus is on funding the most promising companies graduating from Pioneer’s venture building programmes and/or based at its campuses. Since 2015, Pioneer has supported over 80 early-stage ventures which have raised in excess of £200m.

For more information about Pioneer Group, visit www.thepioneergroup.com. Follow Pioneer Group: LinkedIn | YouTube